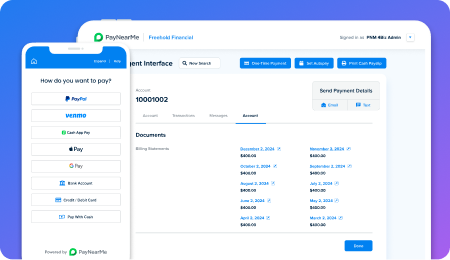

Business Rules

Automate your payments

Mitigate Risk

Lower Declined Payments

Improve Operating Efficiency

Use Cases for PayNearMe Business Rules

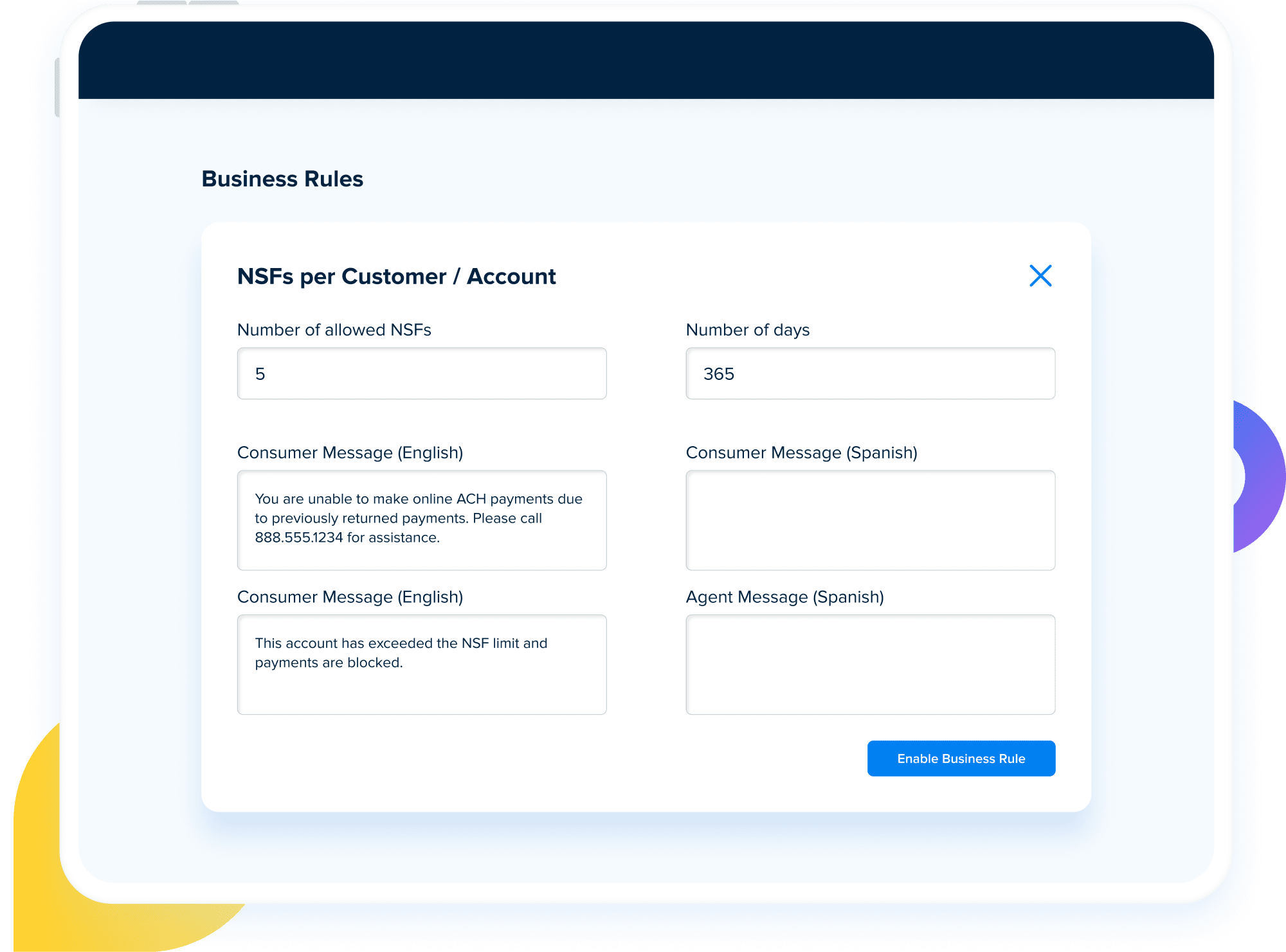

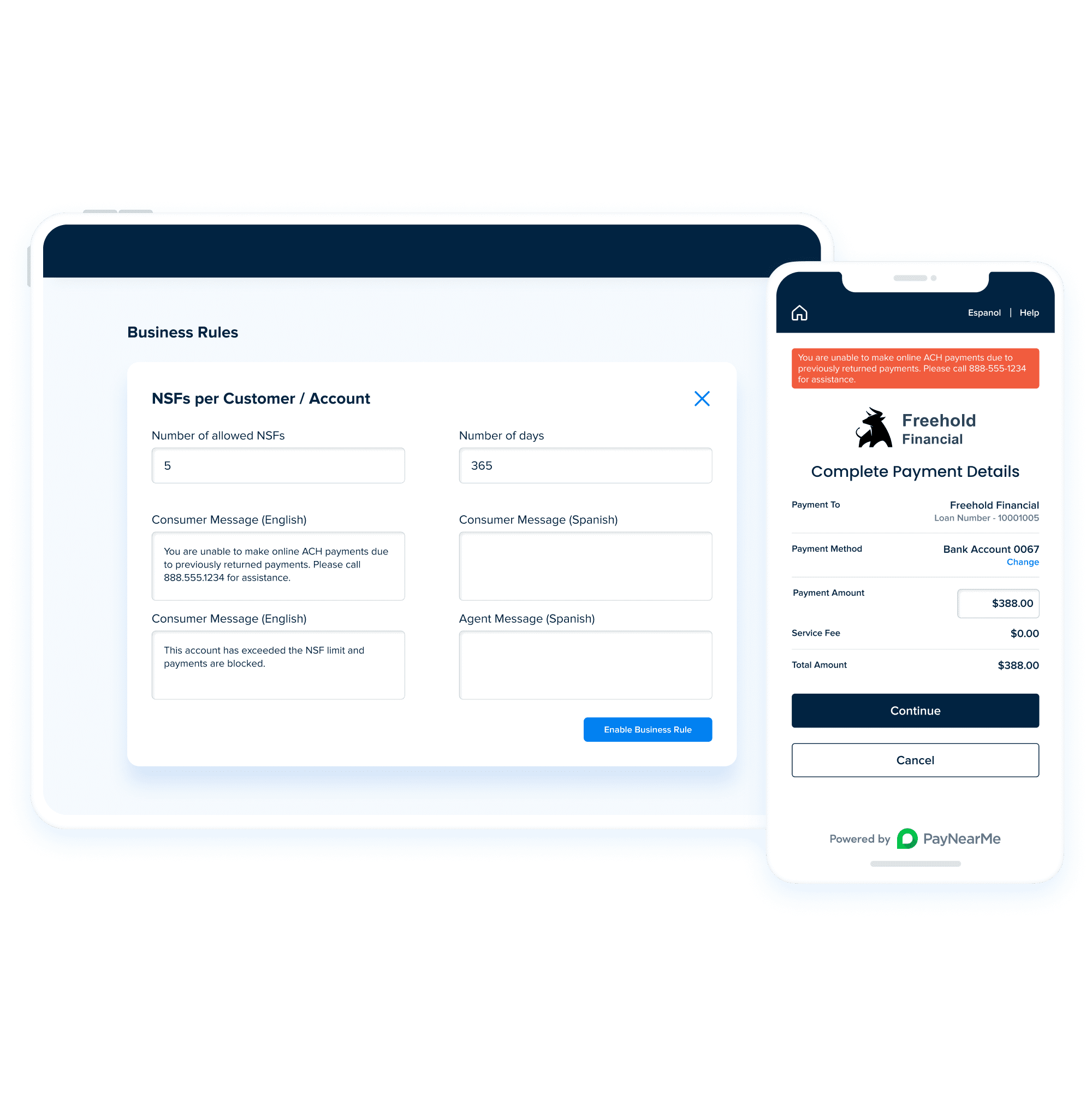

Use our standard business rules inspired by existing clients, or request your own business rules to customize the PayNearMe platform to your requirements.

-

Control Payment Frequency & AmountOnly allow a certain number of payments or payment amount in a certain time period. (e.g., X payments per month or max of $699) to reduce risk.

-

Manage Payment BehaviorsRemove specified payment options if there is a history of unsuccessful payments.

-

Limit OverpaymentsCreate specific parameters around payoffs to reduce overpayments at the end of a loan.

-

Minimize RiskRestrict how far in advance autopay and future-dated, one-time payments can be scheduled.